This tutorial which is part of our SAP FI course talks about SAP G/L account segments in Financial Accounting. You will learn what two segments does a G/L account have in SAP FI and how to maintain them in relevant transaction(s). We will mention the SAP transactions and tables that are related to this process.

This tutorial which is part of our SAP FI course talks about SAP G/L account segments in Financial Accounting. You will learn what two segments does a G/L account have in SAP FI and how to maintain them in relevant transaction(s). We will mention the SAP transactions and tables that are related to this process.

SAP chart of accounts contains a list of G/L accounts to record activities of an organisation. It is required to first define respective account groups and then define G/L account master data at the chart of accounts level. Once the G/L account is created at the chart of accounts level, it can be extended to a company code level, hence we will have two SAP G/L account segments for G/L (General Ledger) master data.

SAP G/L Account Segments

1. Chart of Accounts Segment

This segment is related to creation of G/L account master data at the chart of accounts level. G/L account master data initially must be defined at the chart of accounts segment level. It has to defined as a profit and loss or a balance sheet account.

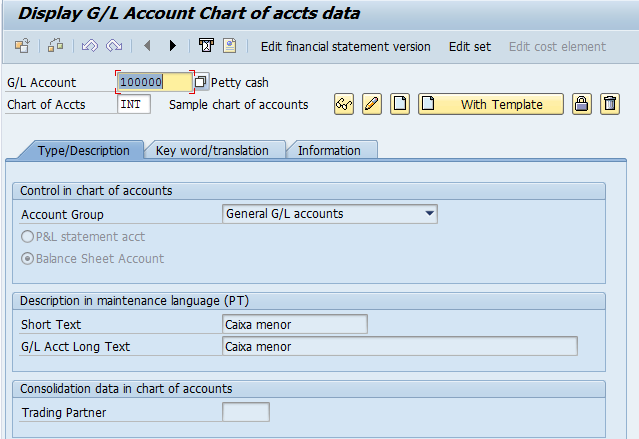

In the SAP chart of accounts segment, we have three tabs of G/L account master data as described below.

Type/description

It contains account group, selection of profit and loss or balance sheet type, selection of retained earnings account (not required for profit and loss accounts, if only one retained earning account maintained at the chart of accounts level), short and long texts, and a trading partner (company).

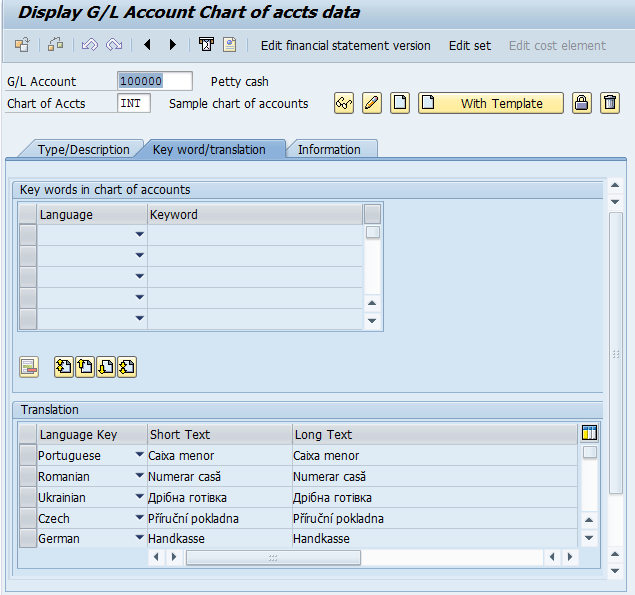

Key word/translation

This tab is used to maintain G/L account description at different languages.

Information

This tab contains information about G/L account master data creation date, created by, and change documents at the chart of accounts level.

It is possible to block or delete G/L account at the chart of accounts level, if no postings have been made yet.

2. Company Code Segment

This segment is related to creation of G/L account master data at the company code level. First, G/L account has to be defined at the chart of accounts level and then only it is possible to extend or create it at the company code level.

In the company code segment, we also have three tabs of G/L account master data as described below.

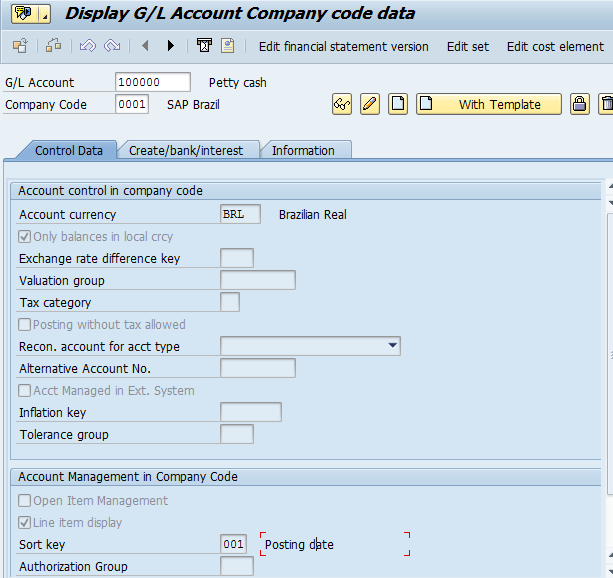

Control data

It contains the following fields as described below:

Account currency: By default, it is company code currency but it is also possible to define with other currency.

Only balances in local currency: To update balances only in local currency when users post transactions.

Exchange rate difference key: To be maintained to fetch foreign currency valuation G/L accounts at the time of valuation.

Tax category: To allow tax postings a tax category has to be maintained. Tax postings are not allowed without a tax category.

Postings without tax allowed: It is possible to post a transaction without a tax code.

Recon. Account for acct type: To define a reconciliation account type asset, vendor, customer or contract account receivable.

Open item management: For balance sheet accounts, if the clearing is needed, then this checkbox is needed.

Line item display: Selected by default. If selected, it activates line item display.

Clearing specific to ledger group: Clearing can be performed at the ledger level. By selecting this checkbox open items and line items will be activated automatically.

Sort key: Sort sequence while displaying line items in reports.

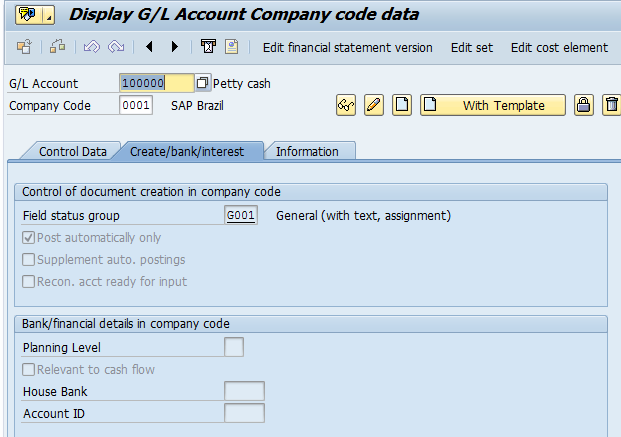

Create/Bank/Interest

It contains the following fields as described below:

Field status group: To maintain field status as required/optional/suppress while booking transactions.

Post automatically only: To avoid manual postings.

Recon. Acct ready for input: To allow alternative reconciliation account functionality and change the reconciliation account while posting.

Information

It contains the following fields as described below:

Created on: Date when G/L account was created at the company code level.

Created by: User who created the G/L account.

Chart of accounts: Chart of accounts where G/L account was created.

Country chart of accounts: Assigned to the company code level.

Country key: Assigned to the company code.

Controlling area: Assigned to the controlling area.

Change documents: G/L account master data changes at the company code level.

Create G/L Account Master Data at Chart of Accounts Level / Company Code Level / Centrally

Path in SAP Menu: Accounting – Financial Accounting – General ledger – Master records – G/L accounts – Individual Processing – Centrally/In chart of accounts/In company code

Transaction codes: FS00 (G/L account master data creation centrally) / FSP0 (G/L account master data creation at the chart of accounts level / FSS0 (G/L account master data creation at the company code level)

Relevant tables: SKA1 (G/L Account Master (Chart of Accounts), SKB1 (G/L account master (company code)

Here you will find screenshots illustrating the process of maintaining SAP G/L account segments for a G/L account 100000 (corresponding to petty cash).

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Balance Sheet and P&L Statement Accounts

Go to previous lesson: SAP Chart of Accounts

Go to overview of the course: Free SAP FI Training

Hi Cleo,

Just want to ask. It was said that it is possible to block/ delete G/L account at chart of accounts level if no posting have been made yet. However if there was posting made, can it still be change? Can the G/L account number be change? Or can we change it’s account group.

Hoping for your advice. Because there were some grouping errors made in our Gl accounts and we would like to correct it. Thanks much! God bless!

You cannot change account number but you can change account group.

Worker Admishon all trainer

MILLIONS OF THANKS TO THE ENTIRE SUPPORT TEAM BEHIND THESE ARTICLES.

ALL ARTICLES ARE EXTREMELY BENEFICIAL AND GIVES AN APT IDEA OF THE SUBJECT IT COVERS.