This tutorial will help the reader to understand the structure of SAP general ledger account (SAP G/L Account), how to maintain a general ledger account, understand the functionality of reconciliation accounts, understand the difference between balance sheet and profit and loss statement accounts and comprehend account management in general ledger (G/L). This tutorial is part of the free SAP FI training and you’re welcome to enroll to our course.

This tutorial will help the reader to understand the structure of SAP general ledger account (SAP G/L Account), how to maintain a general ledger account, understand the functionality of reconciliation accounts, understand the difference between balance sheet and profit and loss statement accounts and comprehend account management in general ledger (G/L). This tutorial is part of the free SAP FI training and you’re welcome to enroll to our course.

Structure of SAP General Ledger Account

An SAP general ledger account is an account that is updated each time a user posts a financial transaction in SAP system. These accounts are used to come up with financial statements for internal and external reporting. In SAP, a general ledger account is identified with a number having from 1 to 10 digits. SAP general ledger accounts constitute master data in general ledger accounting. A collection of all general ledger accounts used by a company is called a chart of accounts in SAP. The chart of accounts contains the structure and basic information of a general ledger account. A complete general ledger account consists of the following segments:

- A chart of accounts segment

- At least one company code segment

Chart of Accounts Segment

The chart of accounts contains basic information about accounts. This information is summarized in a chart of accounts segment. The chart of accounts segment of a general ledger account contains information about the account number, the name of the account, control fields and consolidation fields. The information that a user enters in the chart of accounts segment for an SAP G/L account applies to all company codes. This information need to be entered only once.

Company Code Segment

To use an account from the assigned chart of accounts in your company code, a user must create a company code segment for the account. The combination of the chart of accounts segment and the company code segment form a complete general ledger account. The information in the company code segment controls the entry of accounting documents and the management of accounting data. SAP G/L account can have several company code segments. For example, a user can set the tax category indicator for a specific company code to include taxes when expense accounts are used. For other company codes you may choose not to set this indicator. The information that can be defined in the company code segment includes currency, taxes, reconciliation account, line item display, sort key, field status group, house bank and interest calculation information.

How to Create SAP General Ledger Account?

When maintaining SAP G/L accounts there are two ways. The first one is when the user creates the chart of accounts segment and the company code segment separately. The account will be considered complete and ready for use when the chart of accounts and company code segments have been created. In this tutorial we going to demonstrate creation of general accounts centrally, that is company code and chart of accounts segments created at once. We will explain the function of each and every field when creating a general ledger centrally. The transaction code for maintaining general ledger master records centrally is FS00.

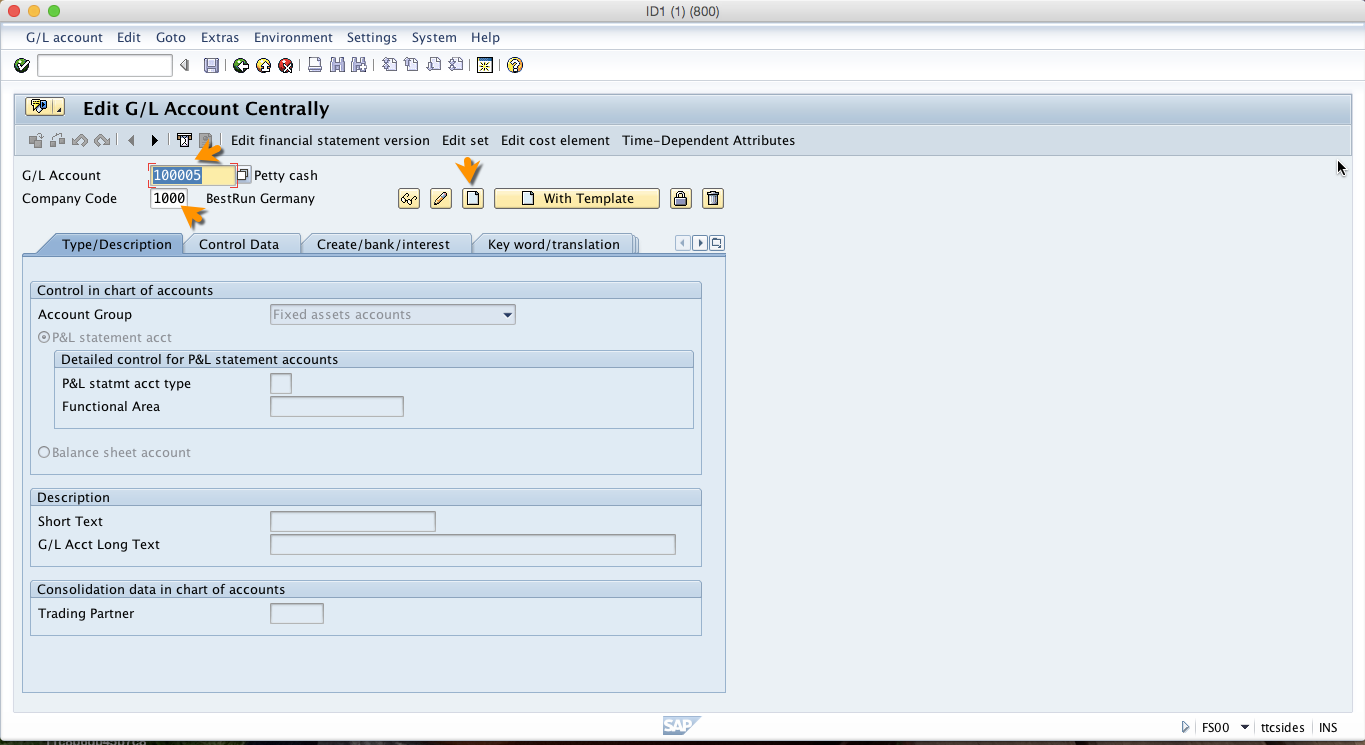

When you start this transaction you need to specify general account number and specify the company code and then click on the Create icon or Create with Template icon as shown below.

G/L Account

The G/L account number identifies the G/L account in a chart of accounts. Here we put the number of the general ledger account that we want to create. The number should be within the number range for the type of the account that we want to create. When creating we can do it with reference to an existing account (to copy existing data and speed up data entry) or we create without referencing any existing account.

Company Code

The company code is the main organizational unit within financial accounting. When creating an account, we specify the company code so that the system will create the company code segment for that account. In other words, by specifying the company code we are making sure that the general ledger account is complete and ready for use in the specified company code.

After entering the company code and general ledger account number you click on create icon and the following fields will be ready for input.

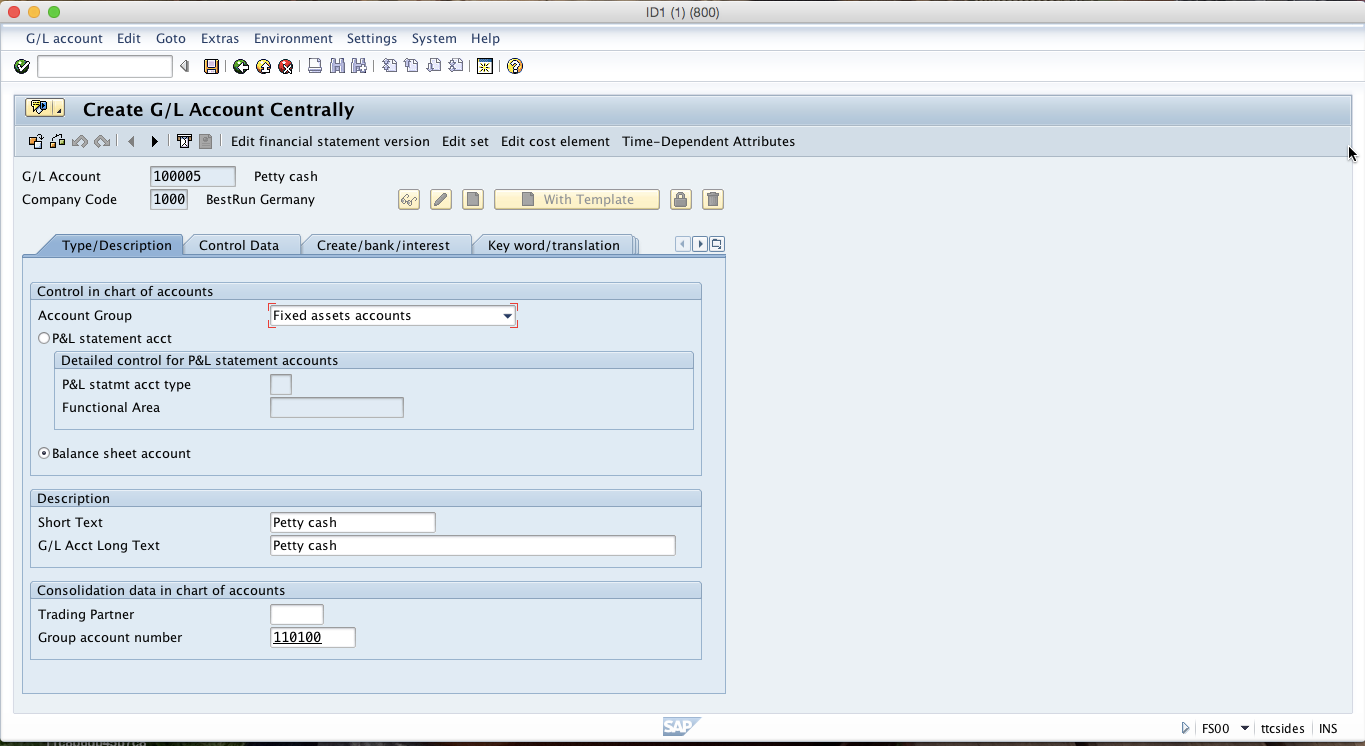

Account Group

The account group is a classifying feature that is used within the general ledger account master records. This field is a required entry which means we cannot proceed without populating this field. The account group determines the fields for the entry screens if the user creates or changes a general ledger master record in the company code. The account group also determines in which number interval the account number must be.

P&L statement acct

This field is a called a radio button in SAP. It means if we click on P&L statement acct, the system will deselect all other alternatives. This radio button means we are creating a profit or loss account. Profit and loss accounts will reduce to zero when the balance carry forward program is run at the end of the year and the balance will be moved to retained earnings account.

Balance Sheet Account

Selecting this radio button means that we are creating a balance sheet account. When a balance carry-forward program is run at the end of the year the account balance will be taken to the next year as opening balance.

Short Text

The general ledger account short text is used for online displays and evaluations which do not have sufficient space for the long text.

G/L Account Long Text

When there is sufficient space, the general ledger long text is used for online displays and evaluations

Trading Partner

In this field we enter the company ID of the trading partner. The company ID is standard for the whole group.

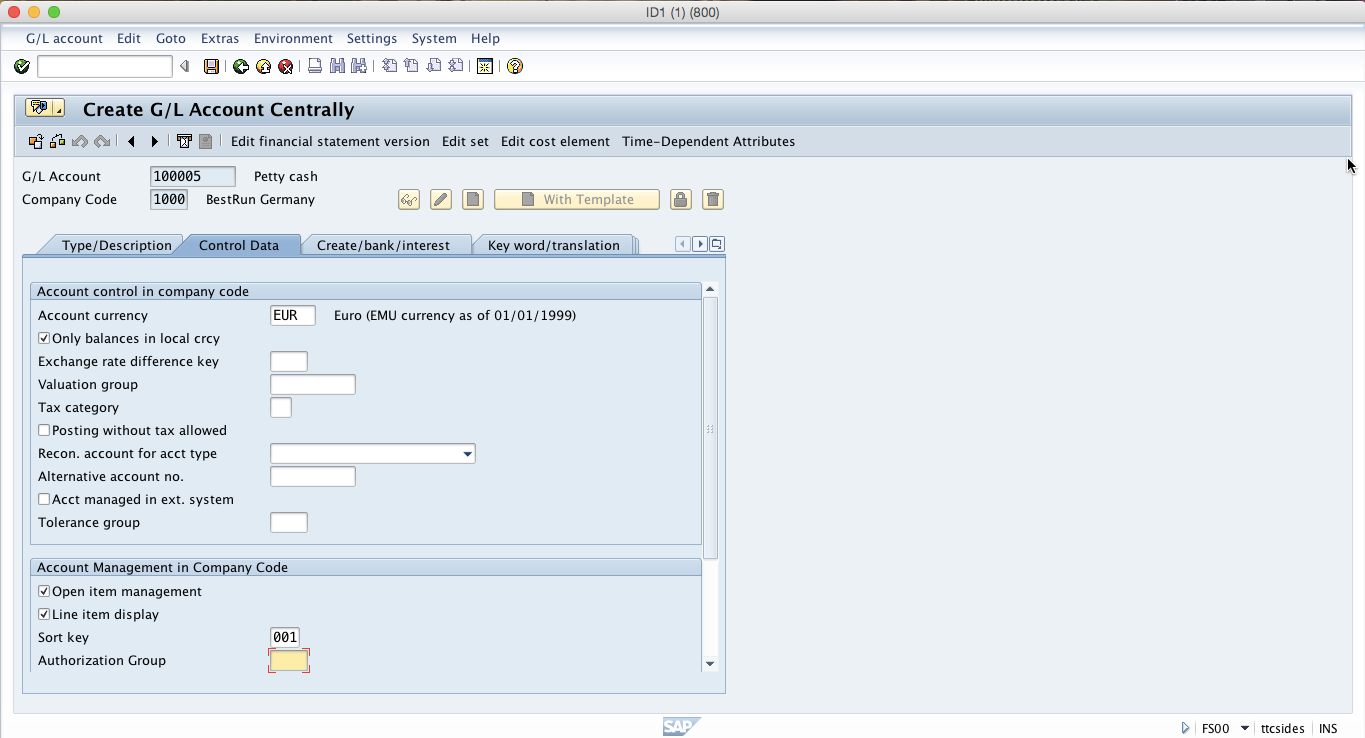

Now, to go to the next tab you should click on the tab labelled Control Data and the following fields will be ready for input.

Account currency

The account currency indicates the currency in which the account is held. If a currency other than the company code currency is specified, users can only post items in that currency to this account. If the company code currency is specified, users can post items in any currency to this account.

Only balances in local crcy

Indicates that the balances are updated only in local currency when users post items to this account. Setting this indicator for accounts managed on an open item basis affects the clearing procedures.

Exchange rate difference key

This is a key for account determination in valuating foreign currency amounts posted to balance sheet accounts.

Valuation group

A valuation group can include a number of different general ledger accounts. The exchange rate is determined from the foreign currency total when the valuation is carried out.

Tax category

This field is used to decide whether you want to use the account for tax relevant postings, if not leave the field blank.

Recon. Account for acct type

An entry in this field characterizes the general ledger account as a reconciliation account. The reconciliation account ensures the integration of a sub ledger account into the general ledger. All postings to sub ledgers are also posted automatically to the general ledgers marked as reconciliation accounts. The reconciliation account itself is not designed for direct postings.

Tolerance group

Group term for SAP general ledger accounts that you are free to define. The tolerance groups are unique within a company code. For each tolerance group, make sure to define the appropriate specifications for the treatment of differences arising from open item clearing.

Open Item Management

Determines that open items are managed for this account. Items posted to accounts managed on an open item basis are marked as open or cleared. The balance of these accounts is always equal to the balance of open items. Accounts that are managed on an open item basis include bank clearing accounts, payroll clearing, cash discount clearing account and goods receipt/invoice receipt clearing account. Accounts that are not managed on an open item basis are bank accounts, tax accounts, raw material accounts, reconciliation accounts, profit and loss accounts and material management accounts posted with a posting key that has account type M.

Line Item Display

Enables line item display for the account. For each line item, an entry is saved in an index table. This entry contains the connection between the line item and the account. In the new SAP General Ledger, line item display is always possible for the general ledger view. You have to set this indicator if you also want to see the line items in the entry view and want open item management. You should not set the indicator for accounts where line item display in dialog does not make sense due to the number of postings. These accounts include tax accounts, receivables, payables and specific revenue and expense accounts.

Sort key

Indicates the layout rule for the allocation field in the document line item. The system uses a standard sort sequence for displaying line items. Among other things, it sorts the items according to the content of the allocation field.

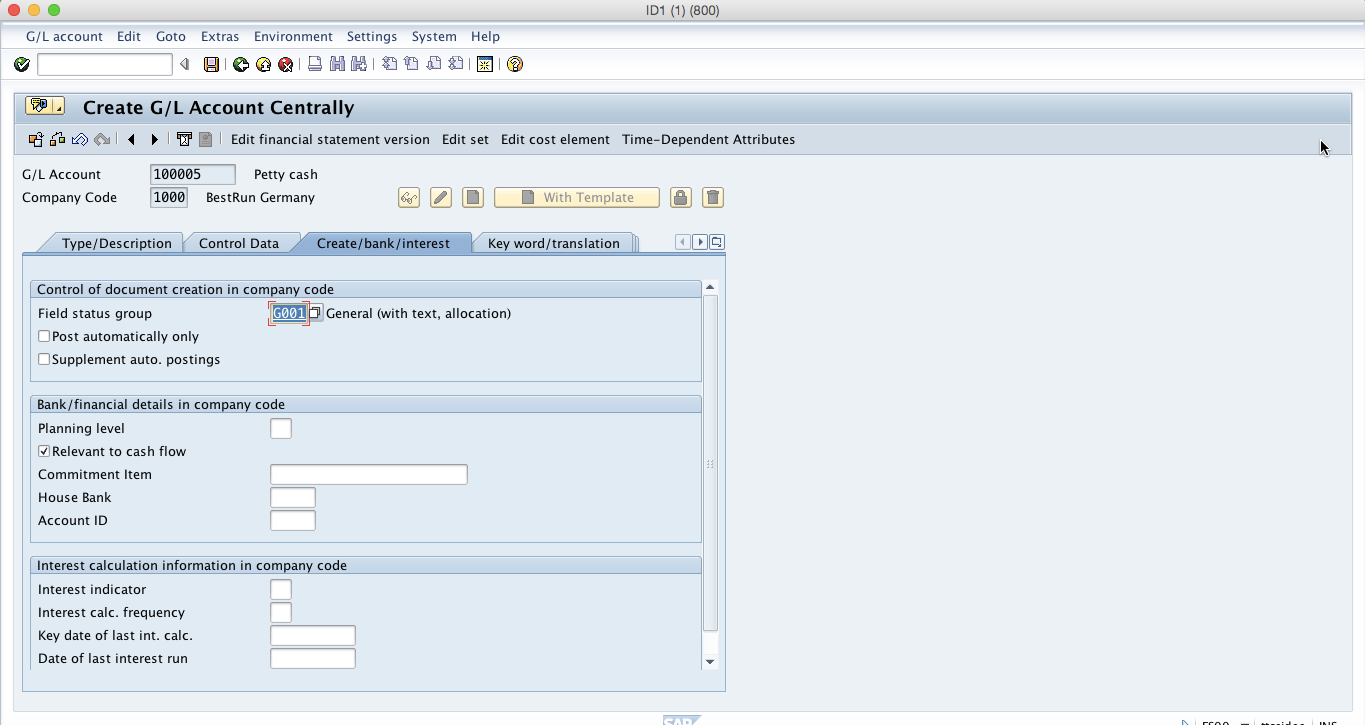

Next, click on the tab labelled Create/bank/interest and when you do it the following fields will be ready for input.

Field status group

Determines the screen layout during the document entry for this account. Fields can have three statuses which are optional entry, mandatory entry and suppressed. For optional fields one can enter data in the field or leave it blank. Mandatory fields are fields that needs to be filled with data for the user to be able to proceed. Suppressed fields are fields that do not appear on the screen.

Post automatically only

Indicates that this account can only be posted by the system using account determination tables.

Supplement auto. Postings

Indicates that the line items which are generated automatically by the system for this account can be supplemented manually. You set this indicator for the general ledger account for bank charges. If you post an incoming payment which contains bank charges, the system automatically generates a line item and supplement it with an account assignment. You should then assign the bank charge to a cost center, for example.

Recon. Acct ready for input

Indicator which determines that the reconciliation account is ready for input when posting a document. The indicator is used in financial assets management.

Planning level

This field is used to control displays in cash management.

Relevant for to cash flow

Indicator that determines that the general ledger account is a cash flow account. Accounts that are typically defined as cash flow accounts include bank accounts, accounts for bank charges, check clearing accounts and clearing accounts for incoming payments. This information is used by the system in order to determine the payment notices.

Commitment Items

Alphanumeric code of the commitment item you are creating, changing, displaying, or to which you are assigning a budget.

House bank

All bank data is determined using this key. House banks are the banks that are used by the company. This field links the general account with the house bank.

After populating all these fields on the tabs of FS00 transaction, you should click on Save button and then SAP general ledger account will be created. At the bottom of the screen you will see a confirmation message that the data has been saved.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Customer Account

Go to previous lesson: SAP Field Status Variant

Go to overview of the course: Free SAP FI Training

Awesome really very useful information.

I like the step by step approach used in the tutorial.It makes topics easy to understand.

This is most useful

Regards

Eric

Simple & Superb explanation of all terms used in GL account.

Great info. thank you

I Need to Create GL and Post entries (for IFRS16) which should not reflects in Management Accounts but its should appear in Statutory account .

How to manage ?

Hi

If you have about 100 lines of General Leger accounts in an excel spreadsheet, is there a functionality in SAP that you can upload this list without individually entering them

Good day experts,

I am new to sap and just finished my training. While creating GL accounts using FS00 in control tab i am find that Tax category, Recon acct type and Tolerance group fields are showing as mandatory which i think should be set as optional. I have gone to FSG – OBC4 and check all the group fields it is showing as optional.

From where is the setting taking place for FSG and how can i make the said fields as optional. Please help me out this is urgent i will be ever gratefull to you all for your help and advise.

Thanks in Advance

When it comes to GL master date fields you should check in OBD4 in Account Group.

Not in FSG-OBC4 is to control the Posting fields like

Eg; F-02 or FB50 for GL Posting and FB60 for Vendor Invoice posting and FB70 for Customer Invoice posting.

You have to check the field status of GL Master data in OBD4 (Account Group).

In OBD4 you will find filed status on the top left click on the field status.

Then under account group double click on the (Account Control) under account control you can change the Tax category, Recon acct type and Tolerance group fields as optional for GL master.

I hope this will help…