In this tutorial, as part of our free online SAP FI training, we will describe the SAP customer down payment process. A down payment is a payment made or received before the physical exchange of goods and services. Upon receipt or delivery of the goods or services, the down payment is cleared against the final invoice.

In this tutorial, as part of our free online SAP FI training, we will describe the SAP customer down payment process. A down payment is a payment made or received before the physical exchange of goods and services. Upon receipt or delivery of the goods or services, the down payment is cleared against the final invoice.

The SAP customer down payment process is required when advances are received from customers to fulfill sales orders before the actual sale has occurred. These customer advances are a liability for the organization which will be cleared by future sales. In this tutorial, we describe the below steps involved in setting up the SAP customer down payment process:

- Create Alternative Reconciliation General Ledger Account

- Link Alternative and Standard Reconciliation Accounts

Once we have completed set-up, we will demonstrate the steps of the SAP customer down payment process by walking through them.

You may recognize that the content of this tutorial appears very similar to our article on the SAP vendor down payment process. Here, we describe the accounts receivable procedure, while the vendor down payment process tutorial concerns accounts payable activities.

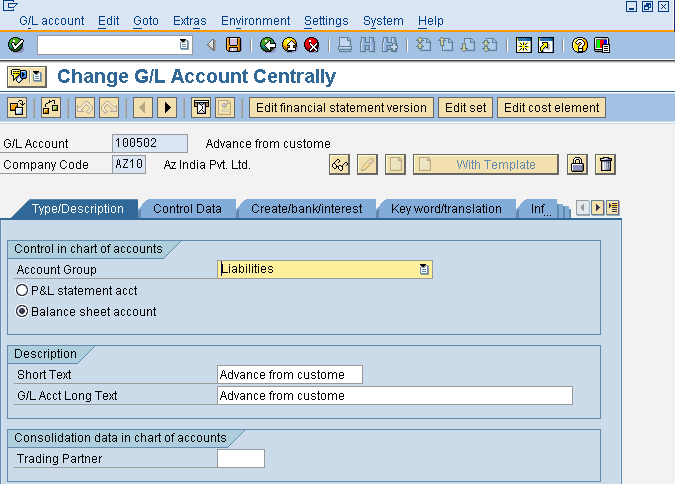

Create Alternative Reconciliation General Ledger Account

Advance receipts from customers need to be shown as liabilities on the balance sheet. In order to support this requirement down payments received are posted as special general ledger (G/L) transactions. An alternative reconciliation account is required to post such transactions. When a down payment is received from the customer the system updates the alternative reconciliation account instead of the standard AR reconciliation account.

Let’s create a new G/L account as an alternative reconciliation account using transaction code FS00. Enter the required fields, including the following information:

- Account texts should be similar to Advance from Customers

- Account group Liabilities

Press Enter to check for errors then Save the G/L account ![]() .

.

This account represents the alternative reconciliation account that will be selected when a down payment is processed.

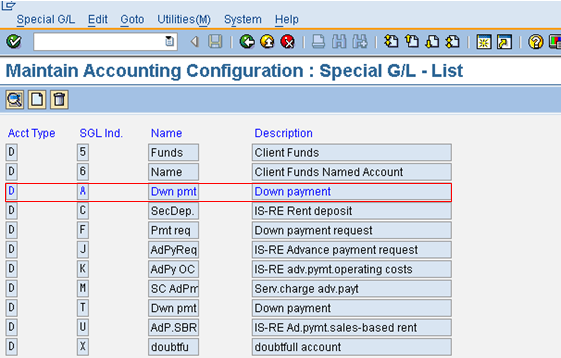

Link Alternative and Standard Reconciliation Accounts

To facilitate the recording of the down payment as a special G/L transaction, a link must be created between the standard reconciliation account and the alternative reconciliation account. To create this link, use transaction code OBXR or use the customizing path below in transaction code SPRO:

Financial Accounting – Accounts Receivables and Accounts Payable – Business Transactions – Down Payment Received – Define Reconciliation Accounts for Customer Down Payments

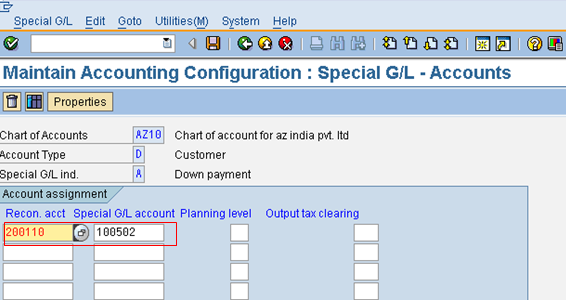

On the special G/L maintenance initial screen, double click on the line with special G/L transaction indicator A – Down payment. Enter the relevant chart of accounts in the resulting pop-up screen and hit Enter.

Link the standard AR reconciliation account with the alternative reconciliation account number you created in the last step. In our example, 200110 is the standard reconciliation account and 100502 is the alternative reconciliation account.

Click the Save button ![]() .

.

If we receive a normal payment against an invoice, the standard account 200110 will be leveraged. However if we receive an advance payment, we use special G/L indicator A and the system will automatically use the alternative account 100502 due to this linkage.

Execute SAP Customer Down Payment Process

Now that we have completed the set-up for the SAP customer down payment process, let’s walk through a demonstration. We will execute the process in sections as follows:

- Post Advance Receipt

- Post Sales Invoice Against Advance Receipt

- Transfer Posting

- Clear Normal Items

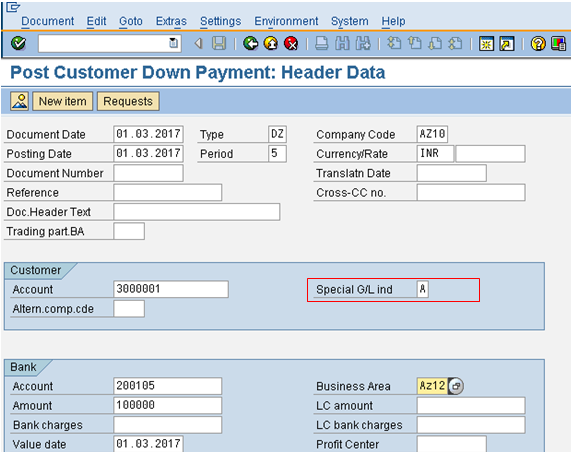

Post Advance Receipt

The process begins when the advance payment is received from the customer. Post the advance receipt as an accounts receivable down payment.

| Menu path | Accounting – Financial Accounting – Accounts Receivable – Document Entry – Down Payment – Down Payment |

| Transaction code | F-29 – Down Payment |

In the initial screen of transaction code F-29 enter the relevant required information and be sure to enter special G/L indicator A as highlighted below:

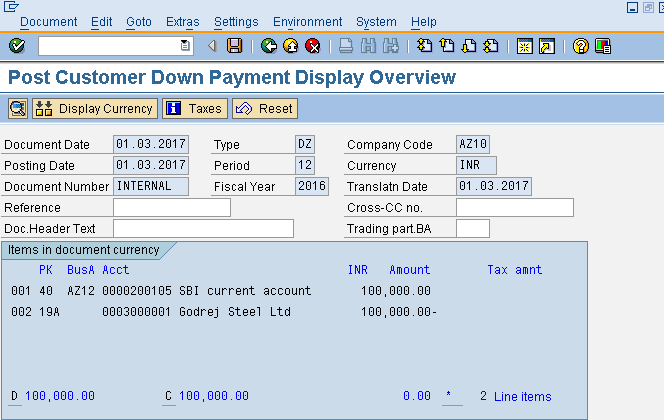

Post the customer down payment. The accounting document will look similar to the below, with a credit to the customer account and debit to the bank account entered in the initial screen:

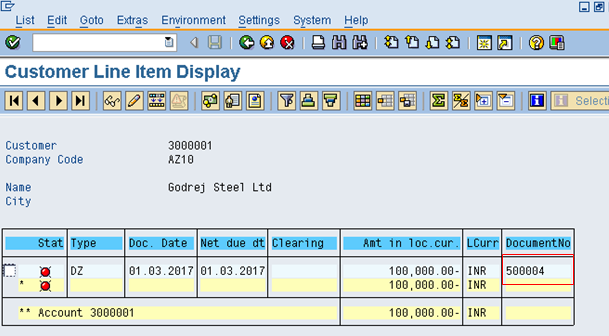

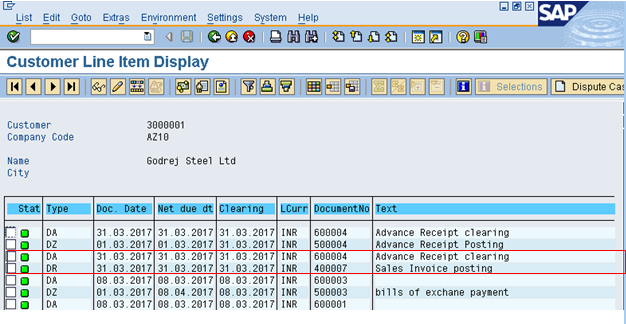

Now let’s see the customer line item report using transaction code FBL5N. In the report selection screen, select the Open items radial button and the Special G/L transactions tickbox. Execute the report and you can see the advance receipt you just created, appearing as a credit to the customer account as shown below:

Post Sales Invoice Against Advance Receipt

Now we will post the sales invoice, signifying that the goods have been delivered or the service has been rendered. This will be offset against the down payment and, if no further payment is required, cleared in the next step.

| Menu path | Accounting – Financial Accounting – Accounts Receivable – Document Entry – Invoice – General |

| Transaction code | F-22 – Invoice – General |

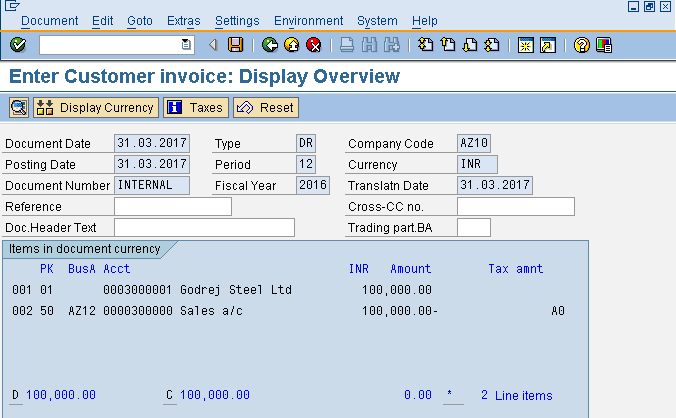

Post the sales invoice for the same customer from which the advance was received in the previous step. The accounting document will look similar to the below, with a debit to the customer account and credit to the sales account:

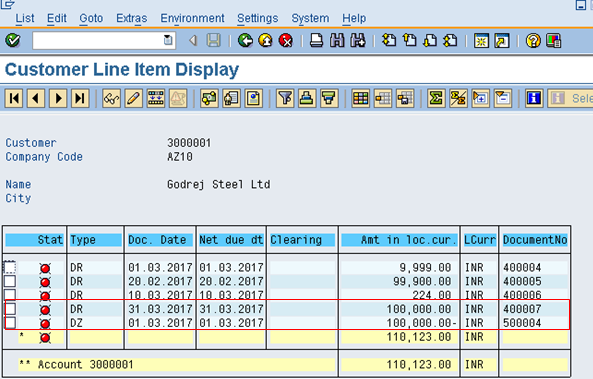

Again, let’s see the customer line item report using transaction code FBL5N. In the report selection screen, select the Open items radial button and both the Normal items and Special G/L transactions tickboxes. Execute the report and you can see both the invoice you just created and the advance receipt from the previous step remain as open items on the customer account:

Transfer Posting

Next, we must transfer the advance receipt amount from the alternative reconciliation account to the standard reconciliation account. That is to say, we will move the down payment from the special G/L to the normal G/L.

| Menu path | Accounting – Financial Accounting – Accounts Receivable – Document Entry – Down Payment – Clearing |

| Transaction code | F-39 – Clearing |

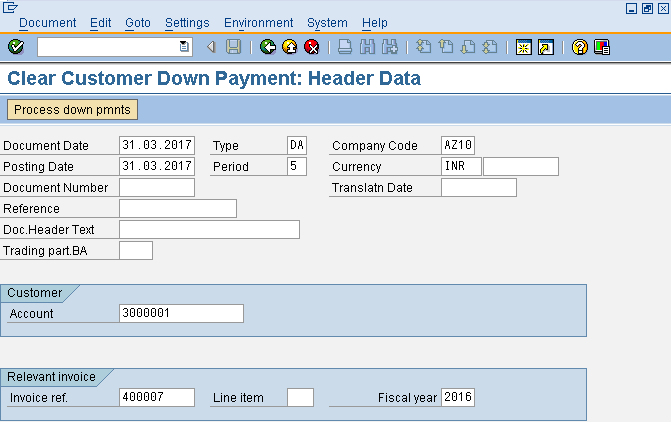

In the initial screen of transaction code F-39 enter the following information:

- Document and posting dates

- Company code

- Customer account

- Sales invoice number created in previous step

Click the Process down pmnts button ![]() to see the advance payments.

to see the advance payments.

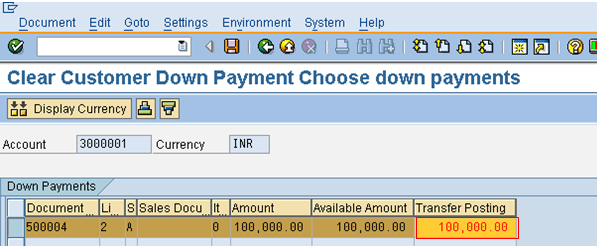

All advance receipts for the customer account are displayed. Select those that you would like to include in the transfer posting. Click the Save button ![]() .

.

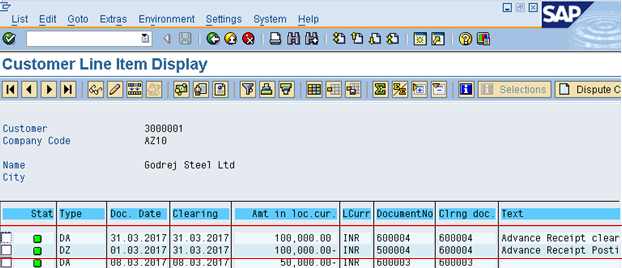

Take a look at the customer line item report using transaction code FBL5N. In the report selection screen, select the Cleared items radial button and the Special G/L transactions tickbox. Execute the report and you can see that the advance receipt document you posted in the first step is cleared by the transfer posting you just made:

Clear Normal Items

Finally, we only need to clear the customer invoice against the normalized advance payment we transferred in the previous step.

| Menu path | Accounting – Financial Accounting – Accounts Receivable – Account – Clear |

| Transaction code | F-32 – Clear |

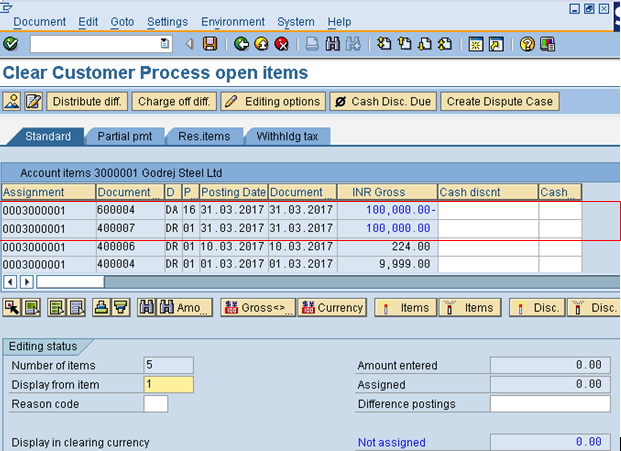

In the initial screen of transaction code F-32 enter the customer account and company code, then click the Process open items button ![]() . In the open items clearing screen, all open amounts remaining on the customer account will be displayed. Double click the amounts of the documents you want to clear. The amounts will turn blue and they will net to 0.00, as demonstrated below:

. In the open items clearing screen, all open amounts remaining on the customer account will be displayed. Double click the amounts of the documents you want to clear. The amounts will turn blue and they will net to 0.00, as demonstrated below:

Click the Save button ![]() .

.

Let’s look at the customer line item report one last time via transaction code FBL5N. In the report selection screen, select the Cleared items radial button and the Normal items tickbox. Execute the report and you can see that the customer invoice you created in step two and the normalized transfer posting you made in the last step are now cleared. At this point the SAP customer down payment process is complete!

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Vendor Down Payment Process

Go to previous lesson: SAP Special G/L Introduction

Go to overview of the course: SAP FI Training

We have a case where 50% services are given to customer & 50% are pending . Customer wants an Invoice for total services 100% & he wants to clear everything together even if part of services will be provided only in future. How do we create invoice for the part of service which is not yet provided i.e. for advance part ?

1. Initial invoice: Dr Debtor / Cr Revenue 100%

2. Correction (unearned portion revenue): Dr Revenue / Sales Creditor 50%

3. When revenue earned (reversal of 2.) Dr Sales Creditor / Revenue

This tutorial is awesome, very clear steps and in the context of the business cases

The tutorial is good, very well explained.

The scenario down payment clearing process without further payment. But what’s the general step if further payment received? suppose customer made 30 percent prepaid and now pay the rest 70 percent? Thx.

Instructions were great, but they only address a one-for-one or dollar-for-dollar scenario. What if the customer paid an advance and wishes for shipments to be made monthly, generating multiple invoices that will need to be applied monthly? Is F-39 – Clearing an all-or-nothing transaction where we have to apply all invoices equaling the advance before moving on to F-32 – Clear?

Very helpful Content

God Bless You…!

Hi friends,

I need to pay back some amounts from the advance payment received from a customer. Basically to split the advanced received amount, so i can proceed with F110 whatever i want to pay back.

Thank you for your comments.

Marino

Hi,

I have some issue in SAP.

When I have cleared the downpayment using F-32 only the ISM Down Payment with document type RV has been cleared (green).

The payment is still open in the system (red).

I do not know why?

Great tutorial. If there is a partial payment up front, is there a way to process the invoice where it will show full invoice amount less the partial deposit and only leave the remaining balance due on the invoice

how to perform advance entry in sap using f-51 (against PI/PO or BG) and then adjusting this advance against invoice received. Please explain step by step process.